Medicare Advantage plans saw the largest-ever decline in Star Ratings in 2023. How can provider directory accuracy boost your Star Ratings?

As Open Enrollment began last fall, Medicare Advantage payers saw a big hit to their 2023 Star Ratings. While some plans managed to weather the ratings storm, some saw drastic changes. In 2022, 68% of Medicare Advantage plans who offer drug coverage had a Star Rating of four or more. That metric dropped 25% for the 2023 ratings with only 51% of Medicare Advantage plans boasting a four or more.

“It’s estimated a Medicare Advantage plan with 100,000 members could lose $15 million in revenue with that lost .5 star.”

With 38 measures to assess the quality of care delivered to Medicare Advantage with prescription drug coverage members, the Star Rating System is administered by the Center for Medicare and Medicaid Services (CMS) and serves as a benchmark for the industry. Maintaining a high Star Rating is essential for health plans to reach enrollment goals as members use the ratings to compare and choose between plans in a competitive marketplace. The highest-rated five Star plans are able to market and sell their Medicare Advantage plans outside the standard enrollment, giving them an advantage when obtaining new members. Not to mention, the ratings also determine the size of the bonuses plans can receive from CMS—any plan rated four Stars or above receives a 5% quality bonus from CMS and has their payment benchmark increased.

What happened with the 2023 Star Ratings?

The steep decline in Medicare Advantage Star Ratings in 2023 was attributed to many factors including fading pandemic flexibilities and members feeling dissatisfied with their plan.

The value of member experience in Star measurement significantly increased in 2023 as member satisfaction played a much more dominant role than they have in previous years. Just how important is member satisfaction when the CMS Medicare Current Beneficiary Survey is also looking at details like cost of care, health disparities, and the number of tests performed? A Gartner study stated member experience metrics represent 57% of an individual health contract’s overall Medicare Advantage Star Rating.

Business impacts for loss in Stars

Projected earnings for insurers take a big hit when Star Ratings drop. Lower-rated plans hope to avoid a drop in enrollment as members compare plans and look for the highest Stars. The competition can be fierce for plans that are looking to hang on to their current members. We know members are comfortable making a change as 22% of those who select a Medicare Advantage plan switch health insurance plans in the next year. Losing members, and enrolling new ones, is costly to plans.

“A Gartner study stated member experience metrics represent 57% of an individual health contract’s overall Medicare Advantage Star Rating.”

Another significant source of income for Medicare Advantage plans is the quality bonuses paid by CMS. MA plans will receive an estimated $10 billion in bonus payments in 2022, according to an analysis by the Kaiser Family Foundation. Losing out on those bonuses will lower overall earnings and projections for the following years.

An uphill Star Ratings battle on tap for 2024

The outlook for next year’s ratings doesn’t look much better for payers. Maintaining and improving Star Ratings is set to become more difficult with the Tukey Outlier Deletion methodology that begins with the 2024 Star Ratings. According to CMS modeling, about 16% of plans could lose at least a half of a star in 2024. It’s estimated a Medicare Advantage plan with 100,000 members could lose $15 million in revenue with that lost .5 star.

How can Veda help health plans boost their Star Ratings?

If your health plan saw your Star Rating drop or are looking to hang onto your current rating, now is the time to get prepared for October’s open enrollment and future ratings. Veda has found accurate provider data is tied to high Star Ratings and existing customers have seen a lift due to their improvements in the directory quality and roster processing.

Veda can directly address two sections of the CMS Medicare Current Beneficiary Survey with our platform’s Smart Automation and access to our national provider database. Accurate provider data from Veda impacts key aspects of the survey, such as:

1. Ease of access to care: How simple is it for your members to find the information they need to obtain?

a. In the last 6 months, how often did you get an appointment for a check-up or routine care as soon as you needed?

b. In the last 6 months, when you needed care right away, how often did you get care as soon as you needed?

2. Quality of member experience: Inability to find a doctor leads to poor member experience.

a. In the last 6 months, how often did you get an appointment to see a specialist as soon as you needed?

b. In the last 6 months, how often was it easy to get the care, tests or treatment you needed?

“If your health plan saw your Star Rating drop or are looking to hang onto your current rating, now is the time to get prepared for October’s open enrollment and future ratings.”

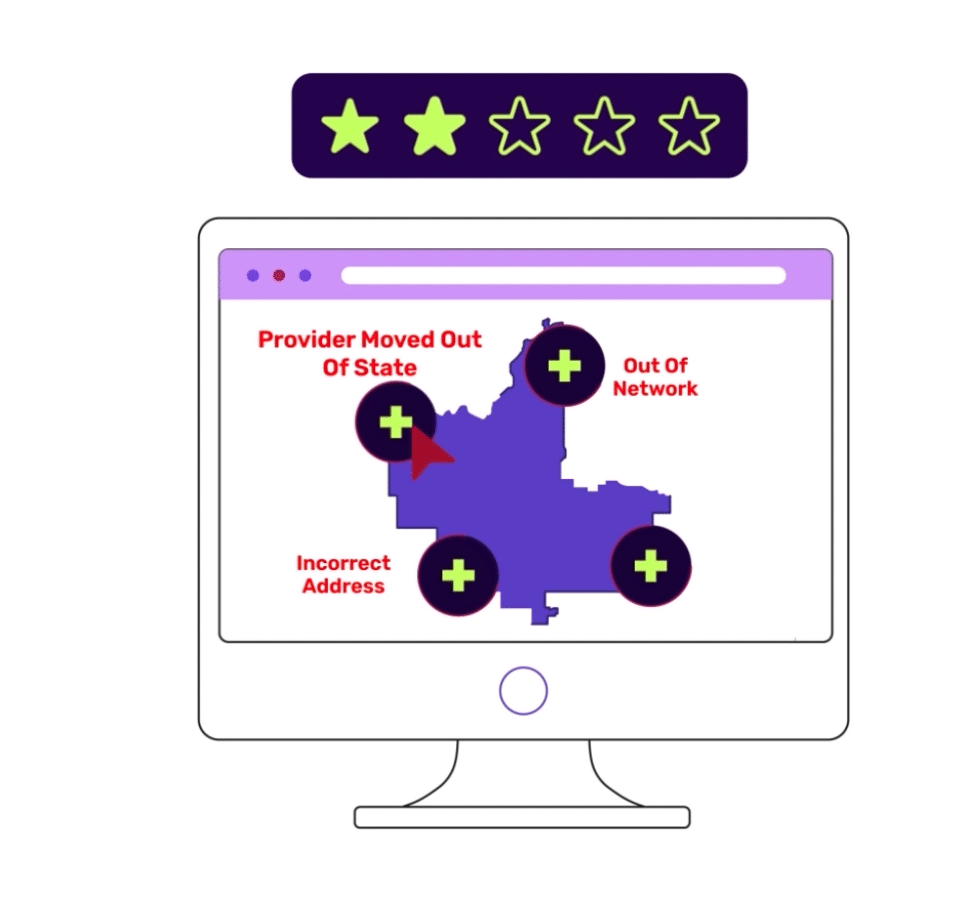

Put yourself in the member’s shoes, imagine a scenario where you are searching for a specialist that is in-network, within 20 minutes of your home, and is accepting new patients. Inaccurate address information in a directory makes the provider you choose seem closer than they actually are. When you finally get an appointment, you find it’s two hours away. Maybe on this journey, you dialed incorrect phone numbers or weren’t even given an updated list of doctors as a new specialist started last month and hadn’t been put into the directory yet.

Put simply: Quality provider directory information means easy appointment booking for members. No more endless phone calls searching for a provider nearby and no more wondering if a surprise bill will arrive due to an out-of-network provider visit. When provider directory challenges are addressed, members and health plans both win.

What else can Veda’s provider data do?

Veda’s technology helps ensure payers meet or exceed CMS compliance benchmarks. Health plans can keep enrollment and Star Ratings in good standing, all while reducing data processing time by 98% and improving data accuracy to 95% or higher.

Prepare for future Star Ratings with a free data assessment from Veda.